1- FIMBANK DIRECT GENERAL QUESTIONS

What is FIMBank Direct?

What are the benefits of using FIMBank Direct?

What are the requirements to use FIMBank Direct?

What device do I need to use for FIMBank Direct?

How do I register with FIMBank Direct?

What is the process of registering with FIMBank Direct?

What is FIMBank Helpdesk?

What is the Enrolment Matrix?

What is the Onscreen Matrix?

What should I do if I change or lose my mobile device?

Is FIMBank Direct compatible with all Internet browsers?

I forgot my password. What should I do?

I forgot my User ID. What should I do?

Are Accounts with FIMBank Direct covered under the Depositor Compensation Scheme?

What is an IBAN?

What is the difference between an Easisave Savings Account and a FIMBank Current Account?

How do I change my password?

What should I do if I encounter technical issues?

Can I allow other people to access my FIMBank Direct Accounts?

Where can I find the latest interest rates offered?

What are standing instructions?

My FIMBank Fixed Term Deposit is due, what shall I do?

How will I receive the FIMBank CAM Enrolment Matrix?

What should I do if I get a new smartphone?

What should I do if I change my mobile number?

What is a certified copy of a document?

What is a Politically Exposed Person?

How often will I receive a Bank Statement and can this be customised?

What are the new features tied to the FIMBank Direct System Update?

Can FIMBank Direct be accessed through a mobile device?

What differences are tied to the main dashboard following the system upgrade of FIMBank Direct?

What functions do the new quick links and widgets serve?

Can I expect any differences in the functionality of the FIMBank CAM App following the system upgrade?

2- LOGIN

How do I protect my device when using FIMBank Direct?

How should I protect my FIMBank Direct Account?

What happens if I do not log out of FIMBank Direct?

What precautions shall I take to protect my online account against phishing attempts?

4- FUNDS TRANSFERS

What are the funds transfers I can make via FIMBank Direct?

What are SWIFT and BIC codes?

Does FIMBank Direct offer personalised funds transfer limits?

Is it possible to increase/decrease my funds transfer limit?

What is the cut-off time for funds transfers?

How do I make an urgent payment?

What is the Single Euro Payments Area (SEPA)?

How do I report a mistake in my online funds transfer?

Do charges apply to internal transfers?

My account was debited, but the recipient claims that the funds were not received. How is this possible?

5- FIMBANK DIRECT FOR BUSINESS

How do I open a Corporate Account?

Can I open a Corporate Account via FIMBank Direct?

How many FIMBank Direct login credentials can I request for my Corporate Account?

6- REQUIREMENTS FOR ACCOUNT OPENING

What do I need to open my first Easisave Single/Joint Savings Account?

What do I need to open a second Easisave Savings Account, if I already have an Easisave or FIMBank Account?

What do I need to open my first FIMBank Single/Joint Current Account?

1- FIMBANK DIRECT GENERAL QUESTIONS

What is FIMBank Direct?

FIMBank Direct is a secure digital banking platform with a number of services catering for both Personal and Corporate Banking customers. FIMBank Direct offers you the facility to:

- Effect payments in a convenient and secure manner

- Make cross-border transfers

- Process multi-currency payments

- Enhanced security through the specific mobile device FIMBank CAM App (no need to carry an extra token for login and transactions) FIMBank Direct enables you to open online:

- Savings and Current Accounts

- Fixed Term Deposits

What are the benefits of using FIMBank Direct?

The benefits of using FIMBank Direct include; Full accessibility with no geographical limitations, enhanced security without the need to carry an additional token, easy and convenient and numerous multi currency options.

What are the requirements to use FIMBank Direct?

In order to use FIMBank Direct, you need to be over 18 years of age, be computer literate, and own a smartphone. FIMBank Direct is not ideal if you do not own a smartphone, or if you are not confident in using a computer/tablet to perform transactions online. If this is the case, it is recommended that you set an appointment with a dedicated FIMBank Helpdesk team member who will provide you with the required support and open the Savings/Current Account or the Fixed Term Deposit for you. To contact FIMBank Helpdesk please call on (+356) 2132 2102 or send an email.

What device do I need to use for FIMBank Direct?

In order to navigate through FIMBank Direct, you will need to own a personal computer and an Android or IOs smart device to download the FIMBank CAM App. For further information, please contact FIMBank Helpdesk on tel: (+356) 21322102 or send us an email.

How do I register with FIMBank Direct?

To register with FIMBank Direct you need to complete the online registration form, providing the Bank with all your details and setting your password.

What is the process of registering with FIMBank Direct?

Once you have filled the registration details, you will receive an SMS on your registered mobile phone including, your User ID. You will then need to log in to FIMBank Direct using your login details (User ID and password). At this stage you will be able to open a new Account. If you are an existing FIMBank/Easisave customer, you will receive an Activation Code via postal mail, which will allow you to access the platform.

What is FIMBank Helpdesk?

The FIMBank Helpdesk is a team of dedicated customer care professionals available to assist potential and existing customers with FIMBank Direct information and technical support over the phone or via e-mail. The FIMBank Helpdesk team is based in Malta and is available between 8.30am and 5.00pm CET on any business day. Should you have any queries please do not hesitate to contact us using the website contact form, sending us an email or telephone number (+356) 21322102.

What is the Enrolment Matrix?

The Enrolment Matrix is a secure colour barcode that will be sent to you by postal mail. You will receive the document a few days after activating your account and will then need to scan this secure colour barcode by using the FIMBank CAM App to reveal the Numeric Code. You will then need to input the Numeric Code in order to complete the Enrolment process. Scan the secure colour barcode from close proximity, within a well-lit room. It is important to keep this document stored in a safe place, as you may need it if you change your mobile phone.

What is the Onscreen Matrix?

The Onscreen Matrix is a secure colour barcode that will appear on the screen whilst you are enrolling or authenticating a transaction. You will need to scan the Onscreen Matrix using the FIMBank CAM App to reveal the Numeric Code allowing you to proceed with enrolment or transaction authentication.

What should I do if I change or lose my mobile device?

If you change or lose your mobile device you are required to re-enrol. To successfully complete Re-Enrolment, one will need the; User ID, mobile number (that you have provided during registration), login password, Recovery Code, FIMBank CAM App (you will need to re-download) and the Enrolment Matrix. The Recovery Code and Enrolment Matrix were sent to you via postal mail, a few days after your User ID was sent to you via SMS.

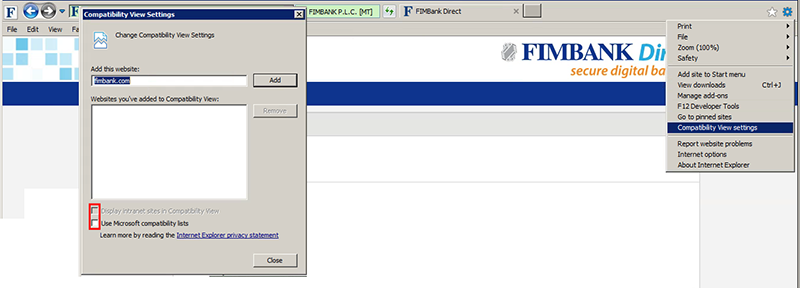

Is FIMBank Direct compatible with all Internet browsers?

FIMBank Direct is compatible with most Internet browsers. In certain cases when using Internet Explorer, you may experience loading time issues. To rectify, you will need to 1) Click on the Internet Explorer browser settings 2) Click on the Compatibility View settings 3) Make sure that the below checkboxes marked in red are unticked

I forgot my password. What should I do?

If you have difficulty with remembering your password and need to change it, you may contact FIMBank Helpdesk, who will send you a new password via postal mail. You may call on (+356) 21322102 or send an email. You may also solve this issue manually by referring to the Recovery Code which was sent to you via postal mail a few days after your User ID was created. Through the Recovery Code, you may change your existing password even though you do not remember it. You will need to click on Log in and 'Forgot Password?'. During this process you will be asked to input the Recovery Code.

I forgot my User ID. What should I do?

If you have difficulty with remembering your User ID, you may contact FIMBank Helpdesk, who will send you your User ID via SMS. You may call on (+356) 21322102 or send an email. You may also solve this issue by referring to the Recovery Code which was sent to you via postal mail, a few days after your User ID was created. You will need to click on Log in and 'Forgot User ID?'. During this process you will be asked to input the Recovery Code.

Are Accounts with FIMBank Direct covered under the Depositor Compensation Scheme?

FIMBank p.l.c. is a participant of the Depositor Compensation Scheme in Malta, established under the Depositor Compensation Scheme regulations, 2015 (‘the Regulations’). The Malta Depositor Compensation Scheme covers deposits in any currency up to EUR 100,000 or equivalent. In case a bank participating in the Scheme is unable to meet its obligations towards depositors or has otherwise suspended payment, the Scheme pays compensation to depositors up to a maximum amount established by law (currently set at a maximum of €100,000). For further information please visit www.compensationschemes.org.mt

What is an IBAN?

IBAN stands for International Bank Account Number. It is a number attached to all accounts within the European Economic Area (EEA), which includes European Union Member States plus Norway, Switzerland, Liechtenstein and Iceland. An IBAN consists of a maximum of 34 alphanumerical characters. The IBAN number is usually displayed on your bank statement.

What is the difference between an Easisave Savings Account and a FIMBank Current Account?

The main difference is that an Easisave Savings Account is linked to a reference account, thus allowing you only to transfer funds to and from the reference account. If you hold an Easisave Savings Account you can also open an Easisave Fixed Term Deposit. A FIMBank Current Account is not linked to a particular reference account, and you are allowed to perform multiple types of funds transfers. The FIMBank Current Account can also serve as a source account from which you can open FIMBank Fixed Term Deposits. These types of accounts also differ in interest rates and fixed term deposit tenors. The initial deposit for an Easisave Savings Account is that of EUR/USD 50 and for FIMBank Current Account is EUR/USD 5,000.

How do I change my password?

Log in to FIMBank Direct and click on the arrow next to your name. A window will open and you will need to click on Change Password. You will then input your old password and your new password, then press the confirmation button.

What should I do if I encounter technical issues?

If you encounter a problem and require support please contact our FIMBank Helpdesk on (+356) 2132 2102 or send an email

Can I allow other people to access my FIMBank Direct Accounts?

No. FIMBank Direct login details are confidential, and specific for each customer. For this reason, you must never allow other people to access your account, not even when you hold a joint account.

Where can I find the latest interest rates offered?

You may find the latest Easisave interest rates www.easisave.com and the latest FIMBank interest rates on the FIMBank website here

What are standing instructions?

Standing instructions are standing orders that you can save on your profile in order to schedule periodical payments which will occur on a future date.

My FIMBank Fixed Term Deposit is due, what shall I do?

Once the Fixed Term Deposit maturity date is due, the principal amount plus interest are transferred back to the source account unless otherwise specified. The maturity instructions are set when the Fixed Term Deposit is initiated.

How will I receive the FIMBank CAM Enrolment Matrix?

You will receive your FIMBank CAM Enrolment Matrix via postal mail. This Enrolment Matrix is the secure colour barcode used for enrolment and future re-enrolment. You should store this in a safe place as you may need it for future use.

What should I do if I get a new smartphone?

You will need to download the FIMBank CAM Application on your new device and proceed with scanning the Enrolment Matrix you had originally received via postal mail following registration.

What should I do if I change my mobile number?

You will need to change the number within the 'Profile Details/Settings' on FIMBank Direct otherwise SMS notifications will not be received.

What is a certified copy of a document?

A certified copy is a copy of a primary document, that has on it an endorsement that it is a true copy of the primary document by a legal professional, accountancy professional, a notary, a person undertaking relevant financial business, such as credit institutions, companies carrying on long-term insurance business and investment firms. During the account opening process, you will be asked for certified copies of certain documents.

What is a Politically Exposed Person?

The term PEP stands for Politically Exposed Person, and generally includes all those who fulfil a prominent public function. The list includes Heads of State, Heads of Government, Ministers, Deputy and Assistant Ministers and Parliamentary Secretaries; Members of Parliament; Members of the Courts or of other high-level judicial bodies whose decisions are not subject to further appeal, except in exceptional circumstances; members of courts of auditors, audit committees or of the boards of central banks; ambassadors, chargé d'affaires and high ranking officers in the armed forces; and members of the administration, and management or boards of state-owned corporations. The following immediate family members of the above persons are also Politically Exposed Persons: the spouse, or any partner recognised by national law as equivalent to the spouse; the children and their spouses or partners; and the parents. Moreover, a PEP is a natural person known to have joint beneficial ownership of a body corporate, or any other form of legal arrangement, or any other close business relations with that PEP; or any natural person who has sole beneficial ownership of a body corporate, or any other form of legal arrangement that is known to have been established for the benefit of that PEP.

How often will I receive a Bank Statement and can this be customised?

You will receive an electronic bank statement on a yearly basis, which is issued free of charge. You may select the option to receive a printed version of this statement, which is also free of charge. You may customise your statement subscriptions through FIMBank Direct. Through secondary and tertiary settings, you may choose to receive statements in additional frequencies (such as monthly, quarterly and semi-annually). A printed version of such statements may be requested via FIMBank Direct only for annually and semi-annually frequencies. Only one hardcopy per year may be provided free of charge. Additional hardcopies may be requested against an additional fee.

What are the new feautres tied to the FIMBank Direct system upgrade?

Mobile Accessibility

One of the key developments surrounding the recent system upgrade, is that it will be accessible across all devices including mobile phones and tables which will further contribute towards added convenience. Access via a mobile device shall be available following the first log in attempt via a desktop computer.

Main Dashboard

ANother significant update within FIMBank Direct is the main dashboard. This is now composed of a fully integrated system, enabling users to manage their accounts more efficiently. The header tabs were also removed with the intention of improved navigation.

Quick Links & Widgets

Quick links and widgets have been incorporated within the platform, enabling access to commonly used functions such as payments, bulk file uploads, and the opening of fixed term deposits.

FIMBank CAM App

While FIMBank CAM App will continue to function in the same way as when attempting to log in via desktop, the only difference is that the App will generate a push notification upon log in when accessing the platform via mobile or tablet instead of scanning the on screen matrix.

Can FIMBank Direct be accessed through a mobile device?

Following the first log in via a desktop computer, FIMBank Direct can be accessed from all devices including mobile and tablets. Kindly follow the below tutorial to access the platform via mobile.

What differences are tied to the main dashboard following the system upgrade of FIMBank Direct?

The main dashboard is now composed of an integrated system, which allows users to effectively manger all their accounts from the main page. The header tabs were also removed and replaced by a vertical drop-down tab for improved navigation.

What function do the new quick links and widgets serve?

Quick Links and Widgets have been incorporated within FIMBank Direct to enable efficient access to commonly used functions such as payments, bulk file uploads and the opening of fixed term deposits.

Can I expect any differences in the functionality of the FIMBank CAM App following the system upgrade?

FIMBank CAM App will generally function in the same way as when attempting to log in via desktop. However, the only difference applied within the system upgrade is that the App will generate a push notification upon log in when accessing the platform via mobile or tablet instead of scanning the on-screen matrix.

2- LOGIN

What is the User ID?

The User ID is received via SMS just after registering and is part of the login credentials required to access FIMBank Direct. This must be kept in a safe place as you will need this for every login.

What is the Activation Code?

The Activation Code is a set of characters sent by postal mail together with a step by step instruction letter which will guide you through the activation process. This applies to existing Easisave and FIMBank customers activating their account within FIMBank Direct.

What is the One Time Password?

The One Time Password is a password that you receive on your mobile phone whilst registering with FIMBank Direct. This password can only be used once and expires after five minutes.

What is FIMBank CAM?

FIMBank CAM is an App which leverages the widespread adoption of mobile camera-phones and provides an easy to use, portable transaction authentication. You will need to use the FIMBank CAM to log in and to authenticate transactions and processes through FIMBank Direct. The FIMBank CAM Application can be downloaded from Google Play Store or Apple Store. Please visit our Security Notice page for additional information on how to download the App safely.

How do I enrol FIMBank CAM?

You will first need to download the App from Google Play Store or Apple Store. You will then need to log in to FIMBank Direct when you have the Enrolment Matrix in hand. The enrolment process consists of 4 steps in which you need to:

- Select Marketing preferences

- Scan the Enrolment Matrix

- Scan the Onscreen Matrix

- Confirm and Log in

How do you use FIMBank CAM?

FIMBank CAM is used to scan the Enrolment Matrix and Onscreen Matrix revealing the Numeric Codes required to enrol, log in or authenticate transactions.

3- SECURITY

How do I protect my device when using FIMBank Direct?

We recommend that you always protect your PC and your smartphone/tablet with a strong password. You should also make sure that the Enrolment Matrix and the Password Recovery Code that you have received via postal mail, are stored in a safe place. If you lose your device, or if you suspect unauthorised access to your online account, please contact FIMBank Helpdesk immediately on tel: (+356) 21322102 or send an email.

How should I protect my FIMBank Direct Account?

We recommend that you always protect your FIMBank CAM Application, PC and your smartphone/tablet with a strong password. You should also make Enrolment Matrix and the Password Recovery Code are stored in a safe place. If you lose your device, or if you suspect unauthorised access to your online account, please contact FIMBank Helpdesk immediately. When you are finished using FIMBank Direct always make sure you log off your account.

What happens if I do not log out of FIMBank Direct?

As part of its security standards, FIMBank Direct automatically logs you out after an extended period of inactivity. Once login time has expired, the system logs you out and you are asked to log in again.

What precautions shall I take to protect my online account against phishing attempts?

You should never log in to FIMBank Direct via a public computer device (such as those found in a Library/ Internet Point/ Hotel). It is also important that you are aware of the dangers of phishing scams. You should always avoid logging in to FIMBank Direct via a link contained in an email. This type of phishing is very common. Furthermore, kindly note that FIMBank will never ask you to verify your login details via email. Please note that you should never access your online account via an unsecured Wi-Fi connection.

Please visit our Security Notice page for additional information on how to keep yourself safe.

4- FUNDS TRANSFERS

What are the funds transfers I can make via FIMBank Direct?

When opening a FIMBank Current Account you will be able to transact multiple types of Funds Transfers. You can: - Effect transactions between own accounts held with FIMBank - Make payments to third party accounts held with FIMBank - Transfer funds to countries within the European Economic Area as per SEPA regulations - Benefit from an international non-restricted transfer of funds as allowed by FIMBank - Schedule periodical payments This applies to both personal and corporate banking customers. When opening an Easisave Savings Account you will be able to transfer funds from and to your linked reference account. You can also schedule periodical payments to this reference account.

What are SWIFT and BIC codes?

A SWIFT code is an international standard format for a Bank Identifier Code. The Bank Identifier Code is a unique identifier for a specific financial institution. The SWIFT BIC is composed of eight characters plus three optional characters identifying the branch. FIMBank p.l.c.'s SWIFT BIC Code is FIMBMTM3.

Does FIMBank Direct offer personalised funds transfer limits?

Yes. The funds transfer limit within FIMBank Direct may be personalised to satisfy specific requirements. You may request a revision of your funds transfer limits at any time.

Is it possible to increase/decrease my funds transfer limit?

Yes. You can send a request for increasing/decreasing your limits for performing financial transactions via FIMBank Direct. In the Funds Transfer section, you will find the limits utilisation option. This allows you to send us a request for amending your limits. The request is subject to Bank approval.

What is the cut-off time for funds transfers?

The FIMBank cut-off-time for funds transfers is 3:00 pm CET. If you effect a payment order via FIMBank Direct by 3:00 pm CET, and you select same day value, the transfer will go through on the same business day. If you select next day value, it will go through the next business day.

How do I make an urgent payment?

To effect an urgent payment, it is important that you send your request before the cut-off-time (3:00 pm), and that you select the same day value option. The fee to make an urgent payment is USD 25 or equivalent. If you are not sure about how to proceed with an urgent payment, you may contact FIMBank Helpdesk on tel: (+356) 21322102 or send an email.

What is the Single Euro Payments Area (SEPA)?

The Single Euro Payments Area is an initiative of the European banking industry aimed at achieving a European Single Market for retail payments. SEPA regulations establish two types of electronic payments: SEPA Credit Transfers and SEPA Direct Debits. SEPA Regulations have achieved transparency in the pricing of electronic payments, while ensuring that payments are received promptly and in full when effected within the European Economic Area.

How do I report a mistake in my online funds transfer?

If an error is made whilst processing a transfer of funds, please contact the FIMBank Helpdesk immediately on (+356) 2132 2102, quoting the Transaction Reference Number. It is important to ensure that the payment details are correct as once a payment is made there is no guarantee of reversing an outgoing payment.

Do charges apply to internal transfers?

A transfer of funds from a FIMBank to FIMBank Current Account is not subject to charges.

My account was debited, but the recipient claims that the funds were not received. How is this possible?

If after three business days the recipient still claims funds were not received, we recommend that you contact the FIMBank Helpdesk, or send us a secure message via FIMBank Direct to check the transaction status. You may contact FIMBank Helpdesk on tel: (+356) 21322102 or send an email.

5- FIMBANK DIRECT FOR BUSINESS

How do I open a Corporate Account?

You will need to contact the FIMBank Sales Team on +356 23280290. A dedicated Relationship Officer will assist you in finding the best solution. Access to FIMBank Direct may be granted to you and other authorised signatories, when the login credentials are provided.

Can I open a Corporate Account via FIMBank Direct?

No. The account opening procedure for a corporate which is new to FIMBank does not occur online. It starts off by contacting a dedicated Relationship Officer who will assist in this process. Once the Corporate Account has been opened, FIMBank personnel will prepare the set up to grant access to FIMBank Direct by setting the login credentials for the authorised signatories.

How many FIMBank Direct login credentials can I request for my Corporate Account?

Corporate Accounts may be granted as many User IDs as signatories. Such signatories must be listed in the Banking Mandate and in the Corporate Board Resolution. FIMBank might grant additional login credentials to access FIMBank Direct in case other signatories join the company provided that any amendment to the signatories list via an original signed Amendment Form together with a Corporate Board Resolution.

6- REQUIREMENTS FOR ACCOUNT OPENING

What do I need to open my first Easisave Single/Joint Savings Account?

To open your first Easisave Savings Account, you are required to provide:

- The account opening form - Can be downloaded via FIMBank Direct. This can be sent via postal mail or a scanned version of the original may be attached.

- The PEP declaration - Can be downloaded via FIMBank Direct. You will need to send a hard copy via postal mail or a scanned version of the original may be attached.

- The Source of Wealth declaration - You can download this document from FIMBank Direct. This can be sent via postal mail or a scanned copy of the original may be attached.

- The copy of identification document - This can include either the ID Card, Passport or Driver’s license. This can be sent via postal mail or a scanned copy of the original may be attached.

- Proof of residential address - This can be a utility bill or bank statement which is not older than 6 months. This can be sent via postal mail or a scanned copy of the original may be attached.

- Opening deposit - An initial deposit of EUR/USD 50 is required

- FATCA documentation - Required if your Nationality/Country of birth/Permanent residential address country/Mailing address/Phone international country code is within the United States of America

- CRS clarification – Required if one of your Nationality/Country of birth/Permanent residential address/Mailing address country/Mobile international country code does not match with the country where you pay tax. You will be contacted by FIMBank Helpdesk for further clarification.

What do I need to open a second Easisave Savings Account, if I already have an Easisave or FIMBank Account?

If you already hold an Easisave Savings Account and you are opening a new one, you are required to provide:

- The account opening form - Can be downloaded via FIMBank Direct. This can be sent via postal mail or a scanned copy of the original may be attached.

- The PEP declaration - Can be downloaded via FIMBank Direct. You will need to send a hard copy/attach a scanned version or send it through a secure message via FIMBank Direct.

- The Source of Wealth declaration - You can download this document from FIMBank Direct. This can be sent via postal mail or a scanned copy of the original may be attached.

- The copy of identification document - You may provide either the ID Card, Passport or Driver's license. It is required only if the document provided in your first account opening has expired or will expire today

- Proof of Residential Address - This can be a utility bill or bank statement which is not older than 6 months. This can be sent via postal mail or a scanned copy of the original may be attached.

- Opening deposit - An initial deposit of (EUR/USD 50) is required

- FATCA documentation - Required if mailing address is in the United States of America

- CRS clarification - Required if mailing addresses does not match the country where you pay tax. You will be contacted by FIMBank Helpdesk for further information.

What do I need to open my first FIMBank Single/Joint Current Account?

To open your first FIMBank Current Account, you are required to provide:

- The account opening form - Can be downloaded via FIMBank Direct. This can be sent via postal mail or a scanned version of the original may be attached.

- The PEP declaration - Can be downloaded via FIMBank Direct. You will need to send a hard copy via postal mail or a scanned version of the original may be attached.

- The Source of Wealth declaration - You can download this document from FIMBank Direct. This can be sent via postal mail or a scanned copy of the original may be attached.

- The copy of identification document - You may provide either the ID Card, Passport or Driver's license. This can be sent via postal mail or a scanned copy of the original may be attached.

- Proof of residential address - This can be a utility bill or bank statement showing the address and is not older than 6 months. This can be sent via postal mail or a scanned copy of the original may be attached.

- Opening deposit – EUR/USD 5,000 - Initial deposit required from account in customer's name/Initial deposit required from third party bank in both names in case for joint account.

- FATCA documentation - Required if your Nationality/Country of birth/Permanent residential address country/Mailing address/Phone international country code is within the United States of America

- CRS clarification – Required if one your Nationality/Country of birth/Permanent residential address/Mailing address country/Mobile international country code does not match with the country where you pay tax. You will be contacted by FIMBank Helpdesk for further clarification.