- Home

- News

- FIMBank aiming for further growth - Bank plans to offer factoring services in Brazil and Mexico (by Edward Rizzo)

FIMBank aiming for further growth - Bank plans to offer factoring services in Brazil and Mexico (by Edward Rizzo)

11.06.2008

FIMBank plc hosted a meeting for stockbrokers and financial journalists on 16 May at Palazzo Parisio to provide an insight into the Group’s strategy.

FIMBank’s President Ms Margrith Lutschg-Emmenegger gave a detailed presentation on the Group’s strategy and future objectives. The President explained that following the initial expansion into factoring and forfaiting in a few selected markets, the Bank’s immediate focus is now to improve its overall profitability by:

(i) Offering factoring in Latin America and China;

(ii) Introducing new products and services including private banking and vendor leasing;

(iii) Growing London Forfaiting Company and reducing its shareholding in the company.

Expansion of Factoring Strategy

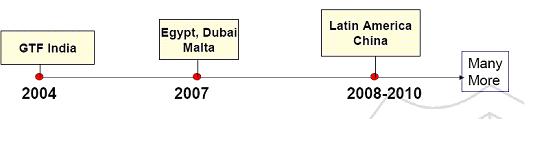

In 2004 FIMBank entered the market of international factoring services through the acquisition of a 38.5% shareholding in Global Trade Finance in India. The Bank’s factoring strategy remains to expand into selected countries which are seen to offer potential as a result of them becoming more politically and economically stable and which are consolidating their position as providers of commodities to developed markets. FIMBank’s aim has always been enter these markets through joint-ventures with supranational investors such as the International Finance Corporation and strong local partners providing knowhow of the market and access to clients. FIMBank intends to repeat its Indian success story by being the first movers in untapped markets. Following the 2004 entry into India, in 2007 FIMBank set up MENAFACTORS in Dubai and EgyptFactors in Cairo. Meanwhile in March 2008 FIMBank sold its 38.5% shareholding in GTF for about US$54 million resulting in a net capital gain of approximately US$28 million. The proceeds from this sale are expected to be used to establish a factoring presence in Brazil, Mexico and eventually also China. During the presentation Ms Lutschg-Emmenegger stated that in Brazil, FIMBank aims to acquire a profitable company together with Banco Latinoamericano de Exportaciones SA (Bladex). Bladex is a supranational bank originally established by the Central Banks of Latin American and Caribbean countries to promote trade finance in the region. Based in Panama, its shareholders include central banks and state-owned entities in 23 countries in the region, as well as Latin American and international commercial banks and institutional and retail investors. In August 2007 FIMBank signed a Memorandum of Understanding with Bladex to establish a joint-venture company which would offer full factoring services to companies, banks and other financial institutions in Latin America. FIMBank and Bladex are expected to each own a 50% shareholding in the company in Brazil. Meanwhile FIMBank also identified a suitable company in Mexico and is shortly expected to commence negotiating an acquisition price. FIMBank’s President also explained that by 2010 FIMBank aims to complete its initial factoring strategy by expanding into China. Ms Lutschg-Emmenegger revealed that Chinese banks do not yet offer factoring and forfaiting on a professional basis and therefore this sizeable market offers very strong potential for FIMBank.

Introducing new products and services

FIMBank’s strategy also involves the introduction of new products in areas where it seems to have a competitive advantage through its unique expertise and relationships. The President revealed that FIMBank aims to offer vendor leasing as well as private banking. While vendor leasing already forms part of the services offered by the targeted company in Mexico, Ms Lutschg-Emmenegger announced at the meeting that FIMBank will also be looking for opportunities to buy into private banking to add this product to FIMBank’s product range for diversification of income streams and optimizing synergies.

Further growth for London Forfaiting Company

FIMBank expanded into forfaiting when it acquired London Forfaiting Company (LFC) in 2003. LFC was recording sizeable losses in 2003 but following an intensive restructuring exercise by FIMBank’s management, LFC registered a net profit of US$4.4 million in 2007. LFC is considered to be a leading global forfaiting company. It operates from its headquarters in London and has offices in New York, Sao Paolo, Istanbul, Moscow and Singapore. During the meeting on 16 May, FIMBank’s President explained that the plan is to reduce FIMBank’s shareholding from the current 100% to a level below 50% since she believes that the company has better growth prospects by being part of a larger organisation following the adoption of the more stringent Basel II capital requirements. In this respect, FIMBank intends to offer to a strategic partner up to 50 per cent shareholding with the additional strategy to take the company public together. Such strategy will provide LFC with additional funding capabilities. This should enable the company to accelerate its growth prospects which will also benefit FIMBank as it will retain a considerable shareholding in the company. A significant attraction in LFC is the substantial deferred tax asset, which the President stated amounts to circa US$22 million, and which will lead to tax credits for a number of years.

The strategic initiatives mentioned above should help to accelerate FIMBank’s profitability in the years ahead. FIMBank is targeting to achieve a post-tax return on equity of 22 per cent in 2010 (2007: 15.4 per cent) and an improvement in the cost to income ratio to 55 per cent from 64.7 per cent in 2007.

In order to fund the continuing growth of the FIMBank Group, the aim is to make an international public offering of shares concurrently with a secondary listing in Dubai. Over the years FIMBank’s growth was funded by the founding shareholders and other General Public shareholders following its IPO and listing of the shares on the Malta Stock Exchange in 2001. FIMBank also conducted two successful rights issues but the President explained that FIMBank is now seeking strategic institutional investors to acquire minority participations which will provide additional expertise and funding requirements through the issue of new shares to sustain growth in the years ahead.

Trading activity has been particularly robust following the stockbrokers’ meeting with over 1 million shares changing hands. FIMBank’s equity has been one of the few positive performers in 2008 as its share price reacted strongly during the first quarter of the year to the sale of the GTF shareholding and the 38 per cent increase in profits during 2007.

To download the article click here

Rizzo, Farrugia & Co. (Stockbrokers) Ltd, “RFC”, are members of the Malta Stock Exchange and licensed by the Malta Financial Services Authority. This report has been prepared in accordance with legal requirements. It has not been disclosed to the issuer/s herein mentioned before its publication. It is based on public information only and is published solely for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. The author and other relevant persons may not trade in the securities to which this report relates (other than executing unsolicited client orders) until such time as the recipients of this report have had a reasonable opportunity to act thereon. RFC, its directors, the author of this report, other employees or RFC on behalf of its clients, have holdings in the securities herein mentioned and may at any time make purchases and/or sales in them as principal or agent. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Neither RFC, nor any of its directors or employees accept any liability for any loss or damage arising out of the use of all or any part thereof and no representation or warranty is provided in respect of the reliability of the information contained in this report.

© 2008 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved